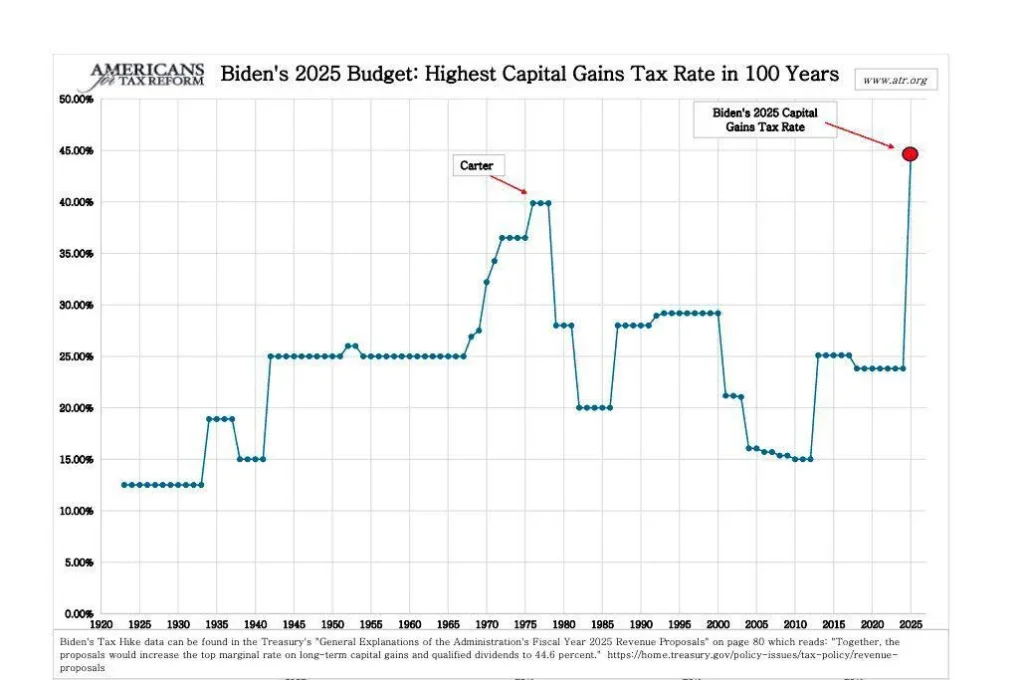

President Biden’s proposed 2025 budget includes a significant increase in the top capital gains tax rate, reaching 44.6%. This would mark the highest 44.6% capital gains tax rate since its creation in 1922. Here’s a deep dive into what this means for investors, business owners, and families planning their financial futures.

Table of Contents

What is Capital Gains Tax?

Capital gains tax is the tax on the profit made from selling certain assets, such as stocks, real estate, or businesses. It’s considered a key revenue source for the federal government, but it’s also a source of concern for many taxpayers and investors. The proposed 44.6% rate has alarmed many, as it could lead to record-high tax bills for those selling valuable assets.

Proposed Rate: Why 44.6% Capital Gains?

Biden’s 2025 budget proposal aims to increase the top marginal rate on long-term capital gains and qualified dividends to 44.6%. This is a substantial jump from the current rates, and it could impact a wide range of taxpayers. With combined federal and state rates, some states could see rates exceeding 50%. For example:

- California: 59%

- New Jersey: 55.3%

- Oregon: 54.5%

- Minnesota: 54.4%

- New York: 53.4%

These high rates could heavily impact business owners, investors, and retirees who rely on their investments for income.

Double Taxation and Inflation Concerns

Capital gains tax often leads to double taxation, especially when the gains come from stocks, mutual funds, or stock ETFs. This is because the capital gains tax is an additional layer on top of the federal corporate income tax, currently at 21%. President Biden’s proposal to increase the corporate income tax to 28% could further complicate the tax landscape.

A significant drawback of the capital gains tax is its failure to index for inflation. This could result in taxpayers paying taxes on gains that aren’t real due to inflation, adding further financial stress.

Impact on Small Business Owners and Families

The proposed rate could affect small business owners who have spent decades building their businesses. When they choose to sell, they could face a capital gains tax of 44.6%, plus state taxes. For many, this is a considerable burden, especially when much of the gain might be due to inflation.

Biden’s proposal also aims to eliminate the stepped-up basis at death, meaning asset transfers to heirs could become taxable events. This could lead to higher taxes for families inheriting property or assets when a loved one passes away.

Comparing Global Capital Gains Tax Rates

The proposed capital gains tax rate in the U.S. would be more than double that of China, where the rate is 20%. This raises concerns about the competitiveness of the U.S. tax system on the global stage, potentially discouraging investment and entrepreneurship.

Conclusion: Navigating the Capital Gains Tax Changes

The proposed capital gains tax hike has sparked significant debate among taxpayers, investors, and policymakers. While it aims to generate revenue for the federal budget, it could also create a challenging environment for business owners, retirees, and families. Navigating these potential changes will require careful planning and expert advice.

Keep an eye on updates and consult with financial advisors to understand how these proposed changes could impact your financial plans and business decisions.